| |

|

- LFTZ

- LFTZB

- ZFTZ

- MFTZ

- Investment

- Resources

| |

Libyan Free Trade Zones

Libya has in the last decade experienced rapid expansion in the construction,

oil & gas, telecommunications, health and agribusiness sectors, and leading

Libyan analysts project sustained growth well into the future. To bring the

country out of its economic isolation and further bolster the Libyan economy,

a number of laws have been passed regarding the creation of free trade zones

(FTZ). The Free Trade Act of 1999 created a legal framework for establishing

offshore free trade zones in Libya. The Libyan General People's Committee's

Law (168) of year 2006 establishes the Libyan Free Zones Board, which will

supervise and run all the intended Libyan free trade zones. Law (215) of 2006,

declares the foundation of Zwara-Abu-Kemmash Free Trade Zone; and Law (32)

of year 2006 declares the foundation of Misrata Free Trade Zone. After a long

period of internal development Libya has began opening its gates

to the outside world by initiating a number of deals with various countries.

Foreign investment and tourism infrastructure development are being given

national priority by the Libyan government. Libya sought

US and other international partners to assist in developing tourism infrastructure

to sustain an estimated 1,000,000 visitors a year by 2015, compared to the

current 130,000. According to Libyan officials at the Tourism Development Authority

(TDA), which serves as a one-stop shop for investors in the sector, the plan

is to create complete tourist cities and free trade zones, and that Libya is

looking for high-income

investors and tourists with the aim to develop high-end tourism, as opposed

to mass tourism. Archaeological treasures, the Sahara

desert, the oases, and the largest collection of prehistoric rock art galleries

make Libya the ideal sun, sea and sand destination of the future. Unfortunately

such dream was shattered to smithereens when the UN ordered its bombing campaign

that destroyed Libya's entire infrastructure and sent the country back to square

one.

Libya's Membership in Other Free Trade Zones

The African Free Trade Zone

Heads of 19 states of member countries

of the Common Market for Eastern and Southern Africa (COMESA) have agreed

in Nairobi to join forces and become a full-fledged custom union

by December 2008. These states are: Burundi, Comoros, Congo, Djibouti, Egypt,

Eritrea, Ethiopia, Kenya, Libya, Madagascar, Malawi, Mauritius, Rwanda, Seychelles,

Sudan, Swaziland, Uganda, Zambia and Zimbabwe. The delegates lamented the ongoing

humanitarian crises in Sudan's Darfur, Ethiopia, Eritrea and Somalia. But despite

controversy and gross negligence and human rights abuses in

Zimbabwe, Robert Mugabe was voted as deputy chairman during the summit. So

if African corruption is to blame for the current state of Africa, as we have

been told, the future of a successful union at this level remains to be seen.

However, the delegates have also discussed efforts to set up a peace conference

for war-torn Somalia, but regardless of whether this is enough to eliminate

the major obstacles for an economic expansion or not, what happens after the

discussion and after the conference remains to be conferred.

The Arab Free Trade Zone

Libya is part of the Greater Arab Free Trade Area (GAFTA), also known as

PAFTA (Pan Arab Free Trade Agreement). The Arab Free Trade Zone, which came

into effect on January 1, 2005, currently comprises 17 member states: Libya,

Lebanon, Tunisia, Morocco, Egypt, Sudan, Yemen, Kuwait, UAE, Saudi Arabia,

Oman, Bahrain, Qatar, Iraq, Jordan, Palestine and Syria. The

discussion to form an Arab free trade zone began in 2001, in Morocco. The Agadir

declaration on the setting up of the zone was signed in Agadir, under the chairmanship

of King Mohammed VI, by the foreign ministers of Morocco, Jordan, Tunisia and

Egypt, in the presence of the foreign ministers of Algeria, Libya and Mauritania

and representatives of Syria, Lebanon and Palestine. The official spokesman

for the royal palace, Hassan Aourid, said that the Arab Maghreb Union (UMA),

which comprises Algeria, Libya, Mauritania, Morocco and Tunisia, and the Gulf

Cooperation Council (GCC), comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia

and the United Arab Emirates, have started dialogue with the European Union

and stressed the need to face up the challenges and requirements of globalisation.

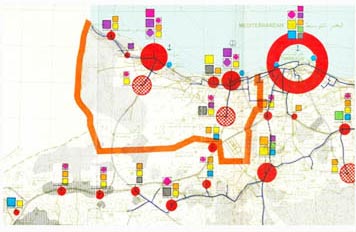

The Mediterranean Free Trade Zone

The European Union Trade Commissioner, Mr. Peter Mandelson, and trade ministers

from Southern Mediterranean countries have agreed to develop a working party,

with the aim of creating a free trade zone which will be in operation by 2010.

The agreement was forged at the 6th Euro-Med Trade Ministerial Conference,

held in Lisbon. The Euro-Med Partnership (EMP), also known as the Barcelona

Process, is a joint venture between the EU and 12 Mediterranean states. The

Barcelona Declaration (of November 27, 1995) set goals reducing political instability

and increasing commercial integration. In 1999, 27 European partners agreed

to conditionally admit Libya. The new free trade zone will be established by

two negotiation procedures: a “bilateral” agreement between EU

members and every country in the Mediterranean area, and a “multilateral” agreement.

The countries that have signed the agreement are: Syria, Lebanon, Tunisia,

Morocco, Israel, the Palestinian National Authority, Turkey, Algeria, Egypt,

Jordan and Libya (which will participate in the agreement as an observer).

|

|

| |

Libyan Free Trade Zone Board

Law (168) of 2006 declares the foundation of the Libyan free

trade zones board. This board is in charge of all the Libyan free trade zones.

What follows is a summary translation of some of the main articles of the law.

The other articles are very similar to the other translated articles of Law

215.

Article (1): defines the meaning of the terms: 'free zone', 'free zones board', 'committee

of the free zones', 'the manager of the committee of the free zones', and 'the

invested capital' as follows: Free Zone (any region of Libya defined by the

law as a special commercial, industrial and trade area free from any custom

duties and taxes as set by the regulations governing the free zones); The Board

(the board of the free zones); The Committee (the committee of the free zones

board); The Manager [or the Chairman] (the general manager of the committee

of the free zones board); The Invested Capital (the foreign currency transferred

to and/or invested in the free zone, the equipment, the products and the necessary

services and apparatuses needed to establish any project in the free zone).

Article (2): defines the creation of a board by the name of 'The

Free Zones Board', with its own independent laws and regulations and finance,

as part of the the General People's Committee for Economics, Commerce and Investment.

Article (3): the head office (headquarters) of the board will be located

in Benghazi, and the board can open other branches in any Libyan region by

a decision from the General People's Committee for Economics, Commerce and

Investment according to a proposal from the board's committee.

Article (4): the board will supervise the committee of the free zones and

work towards developing all the commercial, industrial and service activities

in the zone to the benefit of the national economy and those who desire to

take part in these activities.

The following is a copy of the actual law:

Arabic Copies of the Law

To view large images of Law 168 of year 2006,

please click on the following thumbnails:

|

|

| |

Zuwarah Free Trade Zone

To bring the country

out of its economic isolation and strengthen the Libyan economy, a number of

laws have been passed regarding the creation of free trade zones.

The Free Trade Act of 1999 created a legal framework for establishing offshore

free trade zones in Libya. The Libyan General People's Committee's Law (168)

of year 2006 establishes the Libyan Free Zones Board, which will supervise

and run all the intended Libyan free trade zones; Law (215) of 2006,

declares the foundation of Zwara-Abu-Kemmash Free Trade Zone; and Law (32)

of year 2006 declares the foundation of Meṣraṭa Free Trade Zone.

Law 215 of 2006

Law (215) of 2006, passed by the Libyan General People's Committee,

details the creation of Zwara-Ahu-Kemmash Free Trade Zone. A new government

department, known as The Zwara-Abu-Kemmash Development Zone, was formed to

develop the region as a tourism and investment zone. Al-Saa'di

al-Qaddafi, the chairman of the Zwara-Aby-Kemmash Development Zone and the

son of the Libyan leader Mua'mmar al-Qaddafi, has promised to improve Libya's

economic progress by building the Free Trade Zone in Zwara and bring the country

out of its economic isolation. The area was chosen for the beauty of its beaches

- the best in the whole of Libya - and for its proximity to Tunisia and Europe.

During Tunisia's president Zine al-Abidine's recent visit to Libya, Tunisia

and Libya have agreed to set up a free trade zone between the two countries

including a tourist village on the border. The work has already begun on a

60 by 30 kilometre stretch of land, along the Mediterranean coast between Zwara

and Farwa (an offshore island near Abu-Kemmash, close to the Tunisian border). Zwara's

Free Trade Zone is being built by Emaar Properties, a Dubai's construction

giant that posted a record annual net profit of US$ 1.735 billion. The company,

in a joint venture with the Zwara-Abu-Kemmash Development Zone, is finalising

its master-plan proposals submitted by three US firms and a Singaporean company.

According to Emaar Properties, the joint venture will be a landmark development

for the country as well as for Emaar, and that the various components of the

project will be growth engines for the Libyan economy as they offer investment

opportunities in several high-growth sectors. The zone is a massive project

which will include various residential, educational, leisure and entertainment

components and will have its own

independent laws, regulations, courts, ports and airports. The Department is

also planning to introduce new laws designed to stimulate investment in the

free zone, like tax exemptions and concessions, offshore banking and the introduction

of a liberal social regime allowing a variety of faiths.

Libyan Law

(215) of 2006 Establishing The Zwara Free Trade Zone

The Decision of the General People's Committee

Number (215) Year 1374 (2006 AD)

After considering Law (1) of year 1369 W.R., and the Libyan commercial

law, and the Libyan marine law, and Law (65) of year 1970, and Law (81) of

year 1970, and customs Law (67) of year 1972, and Law (16) of year 1991,

and Law (5) of year 1426 M., and Law (9) of year 1430 M., and Law (3) of

year 1369 W.R., and Law (7) of year 1372 W.R., and the General Committee's

Decree (14) of year 1374 W.R., and what has been decreed by the General People's

Committee in its second meeting of year 1374 W.R., and after the approval

of the General People's Committee during its 27th meeting of year 1374, it

was decided:

Article (1): Establishing a special area by the name of (Zwara-Abu-Kemmash

Development Zone) (which must include the Island of Farwa), with its location

and borders as illustrated in the drawing accompanying this decree, and with

a specified working period of no less than (99) years, renewable by a decision

from the General People's Committee.

Article (2): The zone enjoys its own identity and financial independence,

and can legislate within the boundaries of Libyan law.

Article (3): The goals of the administrative committee of the zone include

advertising and marketing advanced architectural and developmental projects;

the creation of a tourist and industrial environment; various investment

and commercial activities; and encouraging transit trade and goods exchange

operations according to the needs of the market. The administration of the

zone will also work towards providing banking, insurance and investment services

as well as other services, and towards employing and developing the technology

and the knowledge needed to establish an advanced foundation which will contribute

towards developing commercial and trade services to support and develop the

national economy of the country.

Article (4): The Development Zone will work to establish the necessary

services and structures needed to initiate its operations, such as general

services, housing, health, security, safety, education, tourism, commerce,

industry and culture.

Article (5): To achieve its objectives, the Development Zone is authorised

to issue all the necessary decisions, manage its own administration

and finance, encourage and advertise the creation of the foundations, companies,

banks, factories, services and provide employment and other activities

relating to the zone. The zone has the right of ownership of the capital

and property needed to to achieve its purposes.

Article (6): The Zone will be run by an administration formed by a decision

from The General People's Committee, and this administration will then run

and develop the zone according to the principles laid for the free zone.

Article (7): The administrative committee of the zone will have complete

authority and responsibility to run the entire affairs of the zone, and supervise

and guide all the other working institutions within the zone, especially:

- laying the general strategy, plans and regulations to regulate the

activities and the goals of the zone;

- studying the laws and legislation regarding investment and suggesting

improvements;

- laying rules for renting land and property, for granting licenses

and permits for investment and establishing services and industrial and

commercial projects;

- preparing financial estimates needed to study and implement the underlying

environment, building the essential services, the cost of advertising and

marketing until work commences;

- implementing procedures to issue entry, exit and residence permits

according to the needs of the situation;

- agreeing to granting mortgages and investment partnership with other

parties;

- implementing special procedures relating to insurance, social security,

and health amenities to the zone's residents, investors and workers;

- approving contracts and agreements struck with local and foreign

bodies;

- implementing training programs for the zone's workers; undertaking

all that is needed to protect the zone's capital and property and guarantee the

fulfillment of its goals;

- and establishing companies within the zone relating to its activities

and decreeing the necessary regulations and procedure for their activities

according to the law.

The administrative committee is authorised to proxy the head of the

committee with some of these responsibilities, or to form, from within its

current members, a new committee or more than one committee to see to some

of these responsibilities.

Article (8): The administrative committee of the zone will implement

the necessary preparations for its own custom, security and immigration laws,

decreed by the General People's Committee.

Article (9): The administrative committee shall prepare an internal

policy to illustrate its strategy, working procedures and meeting agendas.

Article (10): The zone, its residents and those who invested in the

zone enjoy all the advantages and privileges decreed in Law (9) of year 1430

M. regarding the organisation of transit commerce and free trade zones, and

Law (5) of year 1426 M. regarding the promotion to encourage foreign

investment in Libya, and Law (7) of 1372 W.R. regarding tourism.

Article (11): It is allowed to use English language as well as other

languages, in addition to Arabic, in all the dealings of the free trade zone.

Article (12): The zone will have a seaport and an airport which can

be utilised nationally and internationally.

Article (13): The monetary capital and earnings of the zone will come

from:

- local and foreign investors' money

- the national budgets set aside for the zone

- internal and external mortgages

- income from the zone's operations and activities

- income from investment returns of the zone's capital

- any other incomes resulting from the licensed activities within the

zone.

Article (14): Administrative, financial and organisational protocols

and procedures relating to work, motivation and salaries will be decreed

by the General People's Committee according to proposals submitted by the

administrative committee of the zone.

Article (15): This decree (or decision) is effective from the date of

its issue, and all the concerned bodies should implement it, and be published

in the archive.

The General People's Committee

Issued on 19 Sha'ban

09/06/2006

[End of Document]

[Translated by Temehu.com]

The above translation is based on the following copy of the Libyan GPS's Decree 215

Arabic Copies of the Law

To view large images of Law 215 of year 2006 in Arabic,

please click on the following thumbnails:

Zuwarah Free Trade Zone & Land Confiscation

Confiscation of Berber Land: the head of the

project, Saadi Gaddafi, was reported to have confiscated around 45,000 hectares

of Berber land, stretching 60 kilometres along

the coast (between Zuwarah and the Tunisian border) and 30 kilometres inland

-- way pass Regdalin and al-Jamil.

Berberists from Zuwarah protested

about the true motives behind the project, which they said was designed to

Arabise the area of Zuwarah, and called for the resignation of Saadi and the

appointment of competent experts who would consider the local population into

the workings of the zone and encourage local jobs and investment including

the use of Berber language within the zone.

Legally speaking Article (11) of Law 215/2006 says "It

is allowed to use English language as well as other languages, in addition

to Arabic, in all the dealings of the free trade zone", and therefore

in theory one can use Berber language (under the clause "as well

as other languages").

However, the project had never materialised, and today's NTC had already

declared during the Liberation Day (23 October 2011) that all confiscated land

should be returned to its rightful owners, and urged the Libyan people not

to take matters into their hands and instead wait for the law to implement

justice.

Objections to building ZFTZ in Zuwarah.

The Berbers say the project was instigated by Gaddafi to Arabise Zuwarah; when

in reality it will allow the Berbers an international window through which

they could internationalise their cause.

|

|

| |

Meṣraṭa Free Trade Zone

The name Meṣraṭa is often spelt as Misrata, and sometimes as Misurata,

Mesrata, Mesratha, Musrata, Musratha or Misuratha. Musrata is the name used

by the Libyan Tourism Board, and Misurata is used by the University of Misurata.

The Arabic form used by Libyans, namely مصراتة, is also incorrect because

the the letter 't' should be 'ṭ' (thus the correct form ought to

be: مصراطة).

The

present form of the name, according to some sources, originally comes from

the name of the Berber tribe that settled the area before the town was Arabised

around 200 years ago. The tribe Meṣraṭa was part of the larger Berber

Hawwara confederacy. The original

settlement of Meṣraṭa goes back to the time of the Phoenicians (about 1000

BC) and probably before that. Meṣraṭa's ancient name was Tobakt, which

considering the location of /t/ at the beginning and at the end of the name

one can easily deduce its Berber origin. The association of Tobakt with Roman Thubactis is

doubtful because the town existed long before the Roman invasions.

The Meṣraṭa Free Trade Zone was created by the General People's Committee

as set by Law (495) of year 2000, and was amended by Law (32) of year 2006.

The zone is currently occupying 430 hectares including a portion of the Port

of Meṣraṭa. On January 16th, 2006, Lyamec (The Libyan American Corporation)

has formally received the approval of Meṣraṭa free trade zone to establish

a 24,000 sq. ft. manufacturing and distribution facility in Meṣraṭa.

Arabic Copies of Law 32 of year 2006

To view larger images of Law 32 of year 2006,

please click on the following thumbnails:

|

|

| |

Investment Incentives

Investment In Libya's FTZs

The Libyan Foreign Investment Board was established to facilitate implementation

of foreign investment procedures, like overseeing the application process and

issuing the required licenses for investment projects. Libya produces 1.74

million barrels of oil a day (as of 2010), of which about 1.5 million are exported.

This production is projected to reach about 3 million barrels per day by 2012.

Giving the fact that Libya's oil (and others') will certainly run

out some time in the near future, the Libyan government is looking into other

venues of income such international investment and tourism. Libya has set

up a sovereign wealth fund to benefit future generations, with the aim of sharing

some of the oil revenues with the poor people of Libya.

Owing to recent developments, Libya has witnessed an increased interest of

foreign investors in 2007. Several investment projects,

worth more than 35 billion US dollars, have been announced, and more than $100

billion has

been set aside to buy foreign assets around the world - probably the "frozen

funds" of 2011. In Libya itself, the government is planning to spend $155

billion on local projects, like housing, education and communications - sectors

certainly that will attract foreign contractors. Long term plans will include

investing in funds managed by western banks, land, and companies that can train

and provide jobs for local young people. However, key challenges must be addressed

before Libya can achieve these objectives, like upgrading its infrastructure,

developing its financial sector, introduction of "liberalism", road

safety, and improving its business and tourism policies.

Three of the largest contracts have been signed by Dubai, Dutch and Italian

companies. Emaar Properties has recently signed the Memorandum of Understanding

(MoU) to develop the Zwara-Abu Kemmash Free Trade Zone. The Dutch company

Ladorado has signed a $1.2 billion deal to build 10 tourist complexes by 2012

at Tobruk; and Italy's Gruppo Norman will build the $268 million resort at

Farwa Island, near the Tunisian border. The Libyan Authority for Tourist Development

(TDA) have also signed a deal with the French Agency for tourist, observation,

development and engineering (ODIT) to develop tourist zones in the coastal

regions of Tobrouk and Sabratha.

One of the major changes announced recently is that Libya will open the capital

of more than fifty state-owned companies to foreign investors, each valued

at a minimum of 150 million dollars. Foreign investors will be allowed to acquire

holdings in the larger companies, while small and medium firms will be offered

to Libyan investors. Foreign investors are authorised, under law (5) and amended

by law (7) of year 2003, to invest in industry, health, tourism, agriculture,

technology, training, construction and oil related services (except drilling

and exploration). Telecommunications and finance currently remain the monopoly

of the Libyan government.

Objectives, Incentives & Sectors of Investments In The Free Zones

Objectives

- To improve and benefit the national economy

- To create a competitive investment environment

- To create jobs for the local people

Incentives For Investors

- Health insurance.

- Low energy prices

- Liberal and relaxed social laws.

- Ownership of land and property.

- Project ownership transfer between investors.

- Exemption from custom duties and taxation.

- Exemption from tax on earnings only if reinvested

- Free repatriation of invested capital and earned profits

- Exemption from registration in the trade or industrial registers.

- Guarantees against nationalisation, dispossession and confiscation.

- Free movement of capital and products between the FTZ and foreign countries

- International seaports and airports and land transport services to African countries.

Sectors of Investment

- Technology

- Commerce

- Construction

- Import & Export

- Tourism & Leisure

- Services & Transport

- Banking & Insurance

- Manufacturing and industrial processes

- Unpacking, cleaning and packaging of goods

- Transit Trade & storage of transit and domestic goods

Forms of Legal Foreign Investment in Libya

- Investment in the Free Trade Zones and Transit Trade.

- Investment in oil & gas exploration and production and construction.

- Investment in the fields of Tourism, Industry, Agriculture, Health

and Services.

- Establishment of Joint Companies under the Commercial Law and Law (65)

(1970).

The Main Options Available to Foreign Investors

- Establish a representational office in Libya (via a local agent).

- Set up a branch in Libya (the request to open a branch must be addressed

to the Department of Business Registration at the Ministry of Economy & Trade).

- Establish a joint venture with a Libyan company (which must be at least

51 % Libyan-owned).

Services Available For Investors & Developers

Several projects will be built in and around the free zones to provide all

the services and facilities needed to enable the zones to perform independently

of other areas, including various residential, educational, leisure and entertainment

components, law courts, ports, airports, and banks, which will provide tax

exemptions and offshore banking. However, the current services already available

include:

- Zuwarah Seaport (Zwara Marina).

- Zuwarah Airport.

- Banks.

- Transport (private and public transport, taxis, buses, coaches), and a

plan to build a railway line.

- Tour operators and travel agents.

- Hotels, with several new hotels under construction.

- Shops, cafes, restaurants, local markets.

- Office and car rental services.

- Law court and lawyers.

- Hospital.

- Schools and a university.

- Estate agents providing land and property for sale and rent.

- Several clean beaches: the best in Libya.

- Farms and fertile fields are also available for rent or sale for developers

who want to produce their own food.

- Translators (there are several

languages spoken in the area including English, French, Italian, German,

Japanese, Spanish, Greek and Russian).

|

|

| |

Resources

Libyan Central Bank

P.O.Box 1103

Tripoli, Libya

Tel: (+218) (21) 3333591 , 3333599

Fax: (+218) (21) 4441488

English Web site of the Libyan Central Bank: http://www.cbl.gov.ly/en/.

Arabic Web site of the Libyan Central Bank: http://www.cbl-ly.com

General Union of Chambers of Commerce, Industry

&

Agriculture

P.O.Box 12556

26 Bandong Street

Tripoli, Libya

Tel: (+218) (21) 4441457/8 , 4441613 , 3332655

Fax: (+218) (21) 4443055 , 3340155

World Trade Centre Tripoli

Tripoli Tower

18th Floor, Flat 186-189

Tripoli, Libya

Tel: (+218) (21) 3351326

Fax: (+218) (21) 3351323

The Libyan Businessmen Council

The Libyan Businessmen Council deals with all the affairs regarding Libyan

and foreign businessmen.

Contact: http://www.lybc.org/

Tel: (+218) (21) 3350213 / 3350214

Fax: (+218) (21) 3350374 / 21 3350439

|

|

|

| |